Claire*, 42, was always told: “Follow your dreams and the money will follow.” So that’s what she did. At 24, she opened a retail store with a friend in downtown Ottawa, Canada. She’d managed to save enough from a part-time government job during university to start the business without taking out a loan.

For many years, the store did well – they even opened a second location. Claire started to feel financially secure. “A few years ago I was like, wow, I actually might be able to do this until I retire,” she told me. “I’ll never be rich, but I have a really wonderful work-life balance and I’ll have enough.”

But in midlife, she can’t afford to buy a house, and she’s increasingly worried about what retirement would look like, or if it would even be possible. “Was I foolish to think this could work?” she now wonders.

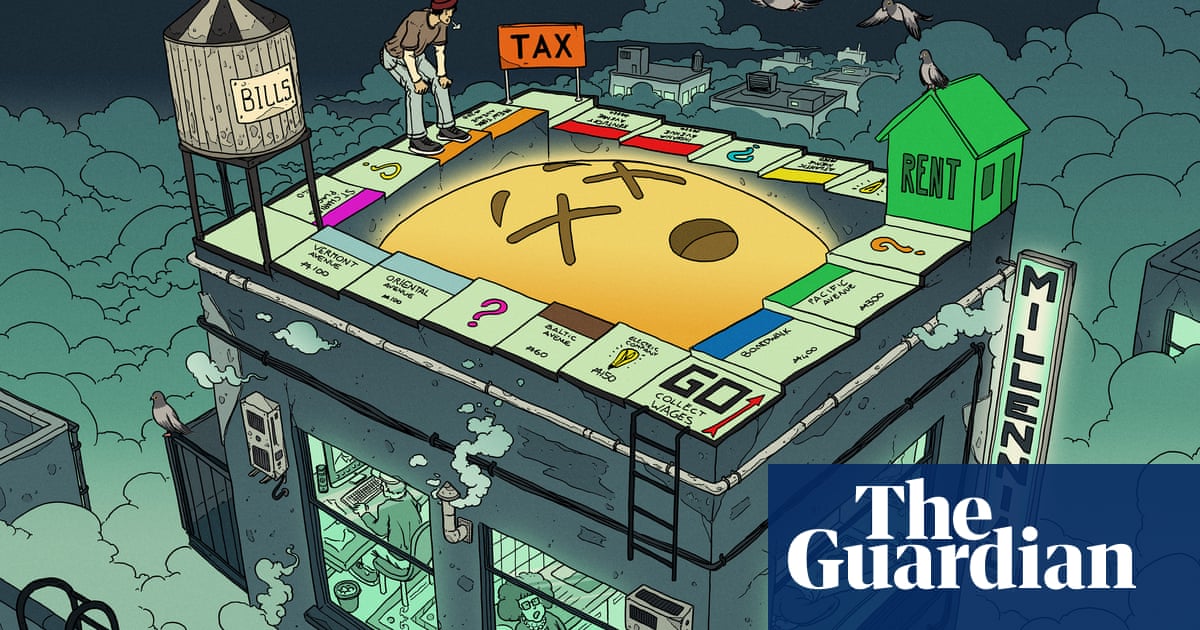

She’s one of many millennials who, in their 40s, are panicking about the realities of midlife: financial precarity, housing insecurity, job instability and difficulty saving for the future. It’s a different kind of midlife crisis – less impulsive sports car purchase and more “will I ever retire?” In fact, a new survey of 1,000 millennials showed that 81% feel they can’t afford to have a midlife crisis. Our generation is the first to be downwardly mobile, at least in the US, and do less well than our parents financially. What will the next 40 years will look like?

I’m a late gen-Xer (born in '80, so I’m more of a “Xennial”). I have a stable job, pension, matching 401k, no kids, no debt (paid off my car and student loans), make 6 figures, and I am STILL convinced that I will never be able to retire. I feel horrible for all those who are in a worse financial situation than me, but we are all really fucked in the next 20 years.

If this is your reality, there’s more wrong with your expectations than your situation.

Social Security is set to run out in the 2030s, and I fully expect the stock market to crash, effectively wiping out my 401k. As others have mentioned, resources like water will start to become scarce, inciting instability.

SSI isn’t set to run out. It will have to be reduced if they don’t take the income cap off of it, however.

But all the other things you said will happen.

Correct. IIRC there’s an auto mechanism that will cut all benefits by 23% or something. So you’re mom/dad getting $2,000 a month would now only get about $1,500.

If you think the stock market crashing wipes your 401k to 0 and that’s realistic you need to get your head checked.

In 2020 it only dropped 20% and bounced back within 3 years.

Where do you chicken littles come from? Lol

That’s very pessimistic.

Not for the entire southwestern United States. There’s 5 major cities off the top of my head getting ready to face a zero day. If you don’t think the stock market is going to react when that happens…

What’s a “zero day” in this context?

Zero day is the day a city runs out of water and must literally truck it in.

Gotcha, thank you!

I call it realistic. If you think everything is going to work out, you’re delusional, man. But I hope you prove me wrong some day, I really do.

Yeah, I’m not going to live my life like that.

Invest in water you say…

You only lose money if you sell. Those who were able to stay the course after '08 made it all back and then some.

The risk is a huge crash right before you retire, or you have to pull from your 401k to fund living expenses.

I think the fear is it stays crashed. Like a new paradigm takes over that is hard to plan for

Well that’s a silly fear.

Same exact boat. Zero confidence I can retire. My best case plan is to move to South America at so. E point and hope I can make it until I die.

Weird flex, but ok

He’s lying.

I’m almost exactly same as you and you’re full of shit.

If you’re honestly making 100k with no debt and one mortgage around 300k you can save 2k a month if your wife makes a decent wage.

Who said they have a wife?