This is clearly photoshopped as a joke. Why is everyone taking it seriously lmao

It’s Lemmy, it’s what we do.

It’s not even a new joke.

It’s Lemmy, it’s what we do.

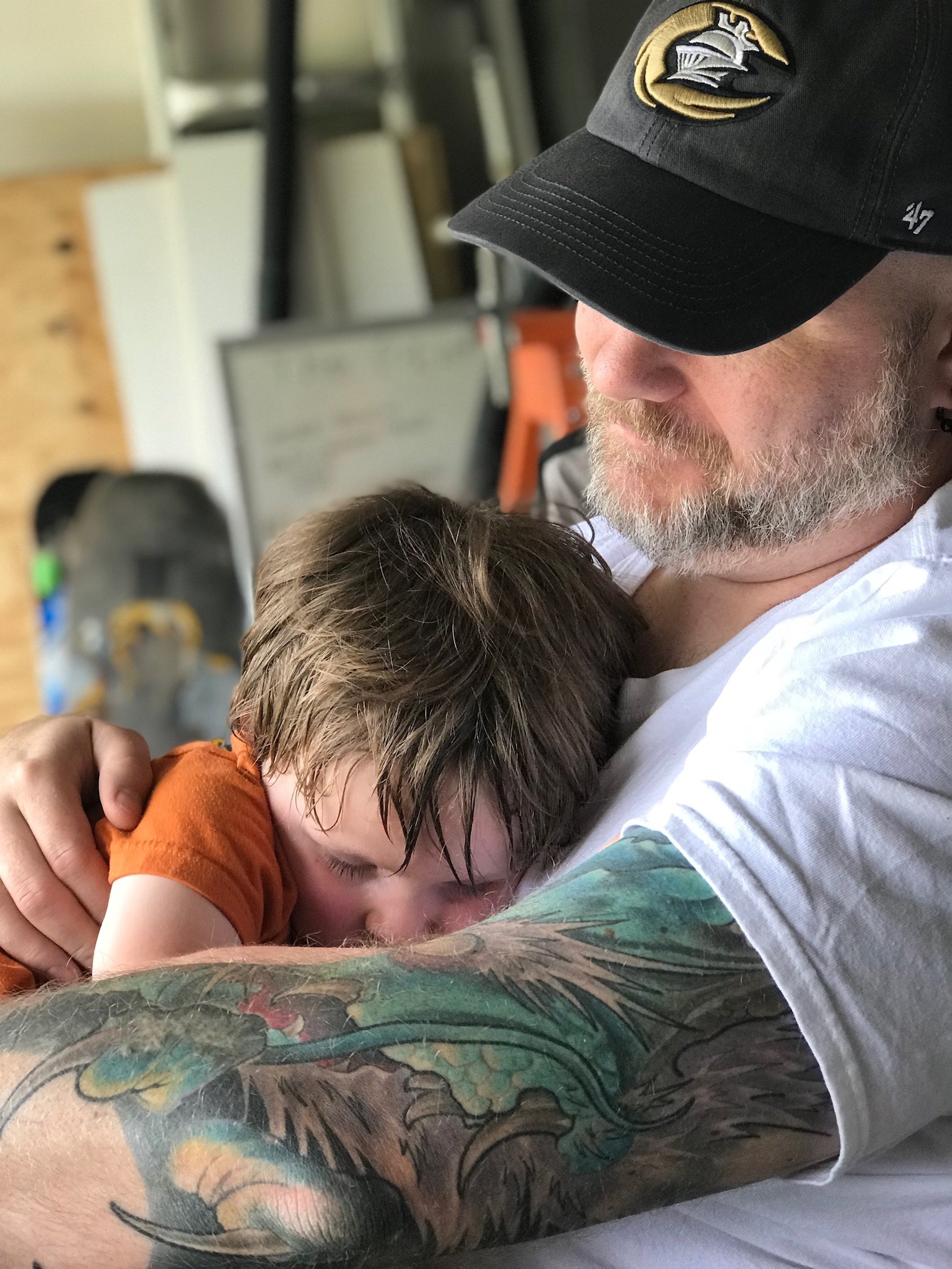

Immediately made me think of this hahaha

Honestly what does retirement planning in America even look like anymore? The next five-ten years are looking to be extremely volatile both financially and politically. It almost feels more risky stockpiling a currency that may lose significant value or even devalue entirely if shit falls apart and/or global war breaks out.

You can’t eat your 401k, buy Mountain House foods by the bucket like your racist uncle! Or something.

If your retirement window is 5 years, you’re probably very very fucked.

If it’s 10 years, as long as you’re assuming social security is going to contribute $0, you’re probably still pretty fucked.

15 years? Maybe, but at that point that whole global climate change thing we’re ignoring is going to start getting more serious, so I’d wager on fucked.

20? Please, you’re already in the trenches of the Water Wars, so your retirement plan is machine gun when you go over the top, sorry.

Basically retirement is going to be you dying once your insurance lapses and someone coming along later to pick your corpse up and billing your family for doing so.

(I’d love to be proven wrong, but ‘What’s the worst most awful thing that could possibly happen’ seems to be the right choice these days.)

Same as every other time in the US’s existence.

Invest in an index fund, let money sit. Repeat.

The US has been through turmoil before. Nearly every country in the world has had similar experiences. Unless you think the concept of capitalism is ending, just prepare for the future the way that’s been done for the last 100 years.

Personally I pulled everything out of index funds right before the market tanked. I know trying to time the market is a fool’s errand, but it was so obvious that the US was about to shit the bed.

Now if that money to will be worth anything in a few years I have no idea. If we pull through I will reinvest. I’m literally thinking about buying gold, something that I thought was stupid just a short time ago.

I have no illusions about the intrinsic value of gold, but I read that JP Morgan Chase flew $4 billion in gold to their vault in NYC a month ago. Other big banks are doing the same.

Fuck the big banks, don’t get me wrong, but they know about risk and hedging.

9/10 times you’ll miss the dip and get behind the curve. You have no idea how the market is going to react in the next 6 weeks, much less in the next 6 years.

Trump could have just as easily not implemented the two days of tariffs and the market could have gone up.

Now that the tariffs are off again, the market might bounce back higher than ever on Monday and you’re going to miss the bounce.

Of course he might say something incredibly stupid tonight and the market crashes, but again, 9/10 times pulling money out of the market means opportunities lost, not bullets dodged.

You’re totally right and normally I would ride the dip. But we’re not in normal times. I’m thinking recession inevitable, depression possible. I’ll try not to miss the bottom of the dip, but that could be years from now. I’m happy with my decision.

He will say something incredibly stupid just about every day, you can take that to the bank. After delaying the tariffs again he announced 250% tariff against Canadian dairy because he misunderstood their variable tariff protection scheme. Even if the tariffs never officially come to pass, this on and off shit is terrible. The market is irrational but it hates uncertainty.

The first rule of investing is accepting you are not smarter than the market.

Not having that money invested is a huge mistake.

Not having it invested has “saved” me thousands of dollars so far. This could be a full on depression coming. The market is not smart. It is irrational.

I’m looking to invest in hesco and fiocchi

The value of almost any car travels in a bell curve. They’re worth a lot when new, next to nothing in 15-20 years or so, then, when most of them have been scrapped, they start to come up in value.

A 20-30 year old truck, particularly one in good condition, will almost certainly be increasing in value, and you can drive it around.

Although a better option would be a nineties Hilux.

No offense, but I feel like if this is true at all, it’s likely still at the very least misleading… I can’t think of really any secondary sales markets in which the most important determination of value isn’t one thing: Condition. (I’m sure there are plenty of arguments to be made for it to be trumped by rarity, but… Let’s be realistic here - unless you’re an archeologist it doesn’t matter how well the pot’s glaze holds its finish, if it amounts to nothing more than a few shards in the end, it’s not going to be quite as awe inspiring as one perhaps more worn yet still intact.)

So, yeah, sure, your 30 year old vehicle could appreciate… Assuming you’ve managed to keep it in something near showroom condition, it hasn’t suffered any major accidental/structural damage, and you not only did all the required/recommended services in a timely manner but also kept the records to prove it. (It also certainly wouldn’t hurt you if that particular make/model ceased production, by any means, either, obviously.)

But I sincerely doubt your F-350 with X00k miles on it that needs a new motor mount and only has 2 knobs left on the console is gonna beat a decent, stable, and well managed index fund investment of the same amount. I’m more than willing to admit my mistake(s) if someone has evidence to the contrary, but I feel like this is another one of those lies ‘temporarily embarrassed millionaires’ tell themselves when they kick the can a bit further down the road of their inevitable prodigious wealth. 😋

So I bought a Challenger R/T with 14k miles on it five years ago. Just that bit of driving in less than a year brought the price down $10k from new. I have put almost 70k miles on it, and it’s now worth $4k more than I paid for it.

For real, if you can get an old Ford truck from the nineties in good condition with low mileage it is probably a better investment than a 4% 401k match. My next door neighbor picked up a decent 90s Toyota truck that had been sitting in a barn for $1000. He is a mechanic so there’s that, but I thought he made an excellent purchase. So what if it’s missing some clear coat and has rust spots in non-critical locations on the body?

Do not buy a new car, ever! Currently having this argument with my wife.

The main value of a new vehicle is your time and peace of mind.

If you walk into a dealership and buy a brand new vehicle, with a five year warranty and a service plan, you have a very good idea what the next five years of driving will cost you, and you can be as certain as possible that the vehicle will be reliable.

Bangernomics makes sense until you factor in your time.

I’m talking something one year used with 10k miles on it will save you $10k+.

That’s pretty expensive for the person who sold it to you, and in terms of peace of mind is the next best thing to buying a new one.

Hopefully anyone buying a new car understands that the second you drive it away it’s losing 20% or more of its value.

You’re both right.

Most of the time condition is the determining factor, but there are cars that even absolutely fucked, the value is in the vin number. You can cut away 90% of the chassis and body, replace it with steel and patch panels from lesser models, source an engine and an interior and “ship of thesius” yourself a “Genuine” 69 R/T Charger.

Also, you’re disregarding the sweat equity equation. Basic spares and repair parts are usually pretty cheap, wiring and mechanical on an old truck is pretty damn simple and bodywork is reasonably easy to learn and do quite affordably if they are smart about it and have the time to put in.

Restoration shops do manage to stay in business because sometimes people want the car they lusted after when they were 16,the kids have grown up and moved out and they have money… condition is less important then.

Honestly, I would think that the whole ‘sweat equity’ aspect would argue more in my favor, to be honest… Even assuming you are doing the necessary restoration work or whatever yourself at cost it doesn’t just magically make that ‘value’ disappear, it would just be externalized and distributed (so to speak) over whatever time you’ve spent acquiring the ability to do so, would it not?

I’m not trying to be argumentative necessarily, but keep in mind I’m considering this strictly from the viewpoint of it being an investment with anticipated return over that of an index over 30 years, so I’m not considering the enjoyment or what have you you might expect from a car enthusiast to be a factor. I also am basing my opinion on my feeling the implication in the original reply was that you could go out right now, get whatever car you wanted, drive it for 30+ years and finally still sell it in whatever state it may be in for something like a 5% return on what you originally paid. Do you consider (or preferably could you provide some evidence?) this to be accurate?

First, we’re talking about buying a vehicle that someone else has taken the depreciation hit on, not a brand new vehicle.

Second, nobody has claimed this will beat a 401k

Third, it’s a shitpost on the Internet. Stop taking everything so seriously.

I strongly encourage you to look up the current price of a Hilux or Supra from the nineties.

Also, stop taking jokes so seriously.

I mean, you’re the one making claims of bell graphs and whatnot here bro… I said I’d be more than happy to correct myself if I’m wrong, but you’re the one making the claims here; That means the onus of proof is on you… I’m not the one who needs to be right so bad they had to say that kinda lame and honestly a bit nonsensical ‘i was joking even though there is clearly nothing in my comment that even remotely supports that interpretation’ thing.

Feel free to keep that ‘do your own research’ energy over there in MAGA land tho… and be a big boy and provide your own proof. It’s really telling (and doesn’t exactly scream ‘credible/competent’ tbh) if the strongest rebuttal you have is… Nothing? Lol

I don’t care enough about your opinion to do any of that.

Believe me or not, I don’t really care.

Ok, sure bubby, whatever makes you feel better 👍 Don’t get all butthurt and confrontational if you’re not confident enough in what you say to bring reciepts tho… I was trying this crazy thing where I see an interesting thread and try to contribute to it and foster discussion. But, i guess just making shit up is cool - You do you lol

👍

I know he was always a Fox News “bootstraps” type, but did Dave Ramsey just give up all appearances of offering “good” PF advice? Wtaf, this is so bad

It looks like it was shopped and is something some boomer would blindly repost.

As a broke kid whose parents thought it would be a good investment, I assure you dude has always been a fucking grifter praying on poverty-stricken Christian families. His advice (read: worthless fiscal platitudes) are like the thoughts and prayers of financial planning… I have literally hundreds of thousands of dollars of bills for chemo we couldn’t even fathom affording while he was dying as my only inheritance to attest to this.

I’m sorry, imo if you’re making a living off of what amounts to a MLM-esque program offering financial ‘guidance’ to people making sub-federal poverty line wages that includes an entire unit on trading stocks then at best you’re an idiot and at worst you’re… Well, Dave Ramsey, apparently.

His advice was always bad.

Somehow, and I don’t get how, he got a reputation for “common sense” financial stuff.

He always was the 10%-to-the-church type which is just braindead if you’re financially strapped: the Jeeesus can live without your money, but your family probably can’t.

Also he’s a sexist, homophobic and probably racist piece of shit (since those come in threes) so really, no reason to do anything other than pretend he doesn’t exist and try to save cult members.

Is this real?